We’re at a crossroads, it’s called H2. The numbers aren’t where they need to be, do you persevere or pivot. Persevere and have confidence in your current direction, pivot to respond to the immediate external pressures, or take a moment to step back and reassess. Re-evaluate your current state of play and your goals, and decide whether your strategy is supporting the business goals.

With so many pressures on FinTech marketing leaders right now, what’s your plan?

I recently attended an industry roundtable and wanted to share some of the insights into the key challenges FinTech marketers are facing right now.

Implementation of AI in Marketing

The roundtable discussed the implementation of AI, focusing on the “how” and “where” of integrating this technology. While there is a clear understanding of AI’s availability and potential, the main challenges lie in navigating its vast landscape. Data security and regulatory compliance are critical to any marketing initiative in financial services, given the importance of data access, data sharing, and the protection of proprietary information.

Adapting to Market Changes

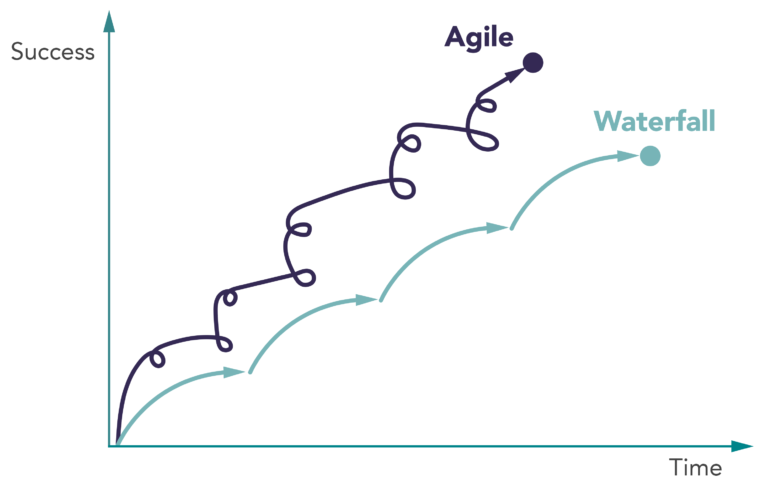

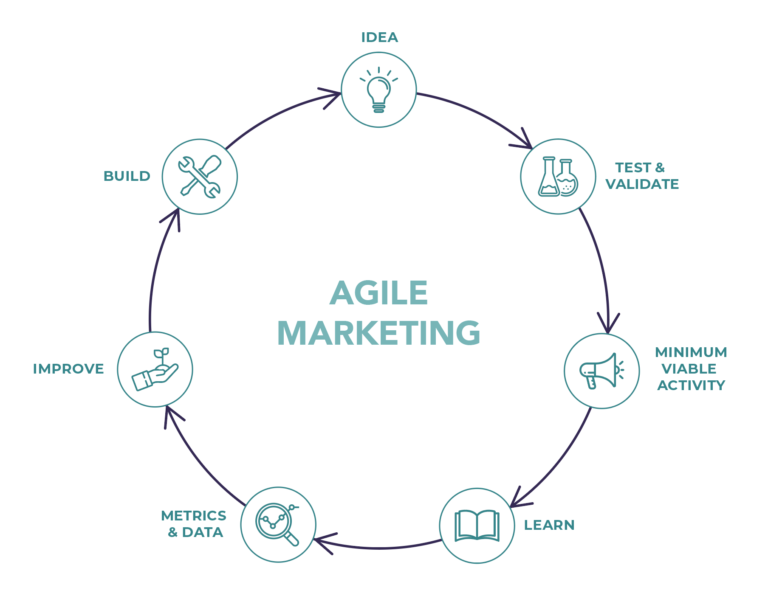

Given the current turbulent market conditions, agility in marketing strategies was a key topic. There is a notable gap in the understanding of agile marketing, highlighting the need for education on proactive adaptation rather than reactive measures. The discussion underscored the importance of strategic decision-making—knowing when to pivot and when to persevere. Despite the necessity for immediate results, participants acknowledged that these expectations often misalign with market realities. Budget constraints for testing new strategies remain a significant challenge, but there was consensus on the need for bold investments and calculated risks, alongside smaller-scale testing.

Market Performance and Inbound Inquiries

The first half of the year has seen most businesses struggle, with a notable decline in inbound inquiries. This situation has led to a reassessment and realignment of targets for the second half of the year.

Adoption of MarTech and SalesTech

Adoption rates for marketing technology (MarTech) and sales technology (SalesTech) remain low. There was a robust discussion on the necessity of high-quality data and system interoperability. The group explored strategies to encourage sales teams to adopt new technologies, emphasising the need to clearly demonstrate the value these tools bring to their processes. One innovative approach discussed was the potential launch of a pilot campaign to align marketing and sales teams, ensuring a shared understanding of technology benefits.

Marketing and Sales Alignment

A recurring concern was the inefficiency of lead conversion. A significant proportion of leads handed over to sales teams fail to progress, raising questions about alignment between marketing and sales. With only about 10% of leads converting, the discussion centred on strategies to maintain engagement with the remaining 90% and the cost implications of generating these leads. Effective collaboration between marketing and sales is essential to improve lead nurturing and conversion rates.

At Bright, we help businesses who are at a point when they want to see improvements in their effectiveness, efficiency or engagement but not sure how to move the dial. We believe that it’s the way your teams work that underpins your ability to adapt to change and drive results.

By adopting agile marketing principles and practices, you can transform marketing within your organisation to boost collaboration, ensure continuous improvement and the become more empowered to demonstrate the value of marketing to the rest of the business.

If you’re interested in learning how to upskill your marketing team, contact us about our FinTech Agile Marketing Training.